arizona maricopa county tax lien

Tax Lien Lawyers in Maricopa County. Tax Deeded Land Sales.

Get A Look At Phoenix And Nearby Cities In Maricopa County Avondale Arizona Maricopa County Buckeye Arizona

The lowest bidder is the winning bidder and receives a certificate of purchase for the tax lien.

. Do not include city or apartmentsuite numbers. Many people think that IRS liens have higher priority. By law Arizona property taxes have the highest lien priority.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. In fact IRS liens priority is based on the order recorded. Contra Costa County Sales Tax Increase 2021.

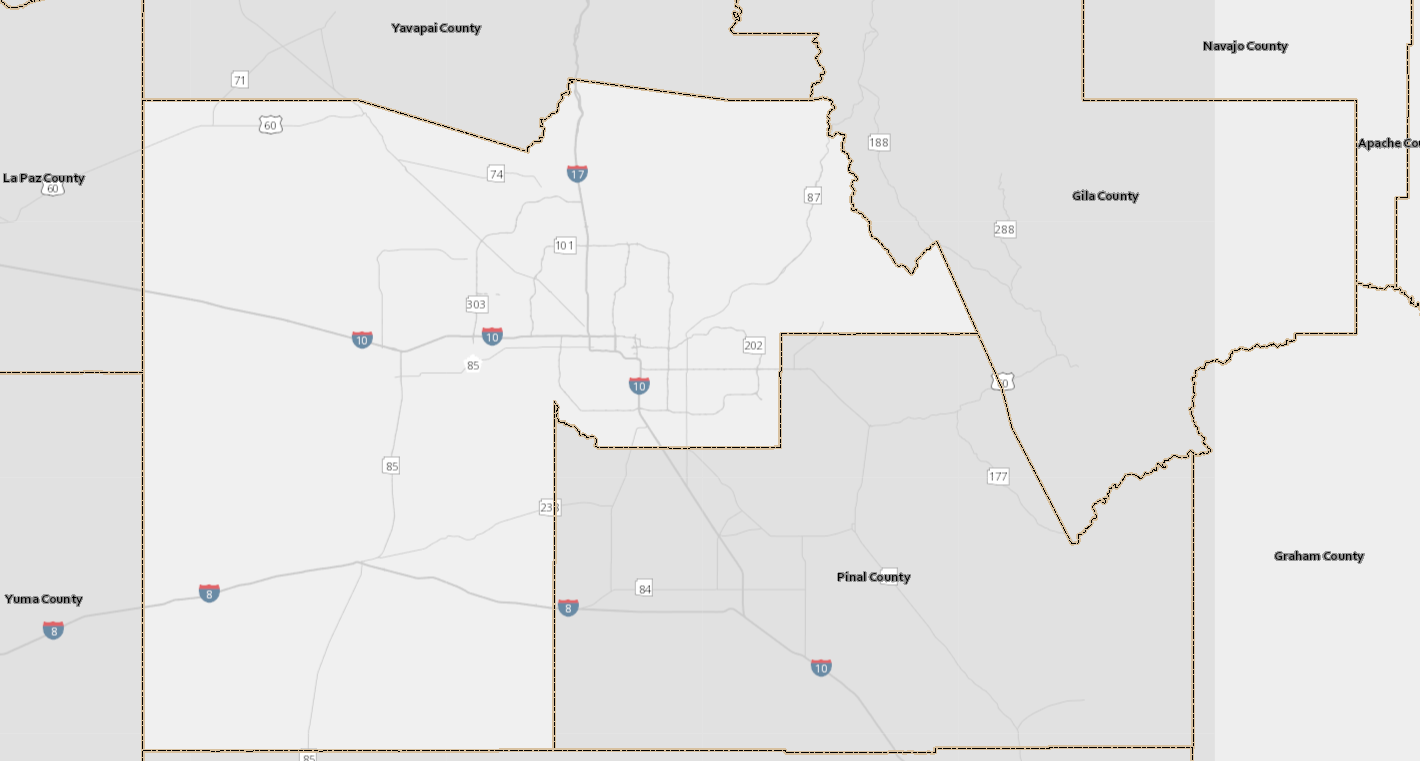

Directing the maricopa county arizona treasurer to execute and deliver to the purchaser of the maricopa county arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the maricopa county. When you purchase tax lien certificates youre investing with the government and getting paid by the government making it one of the safest investments in America. You can now map search browse tax liens in the Apache Cochise Coconino Maricopa Mohave Navajo Pima Pinal and Yavapai 2022 tax auctions.

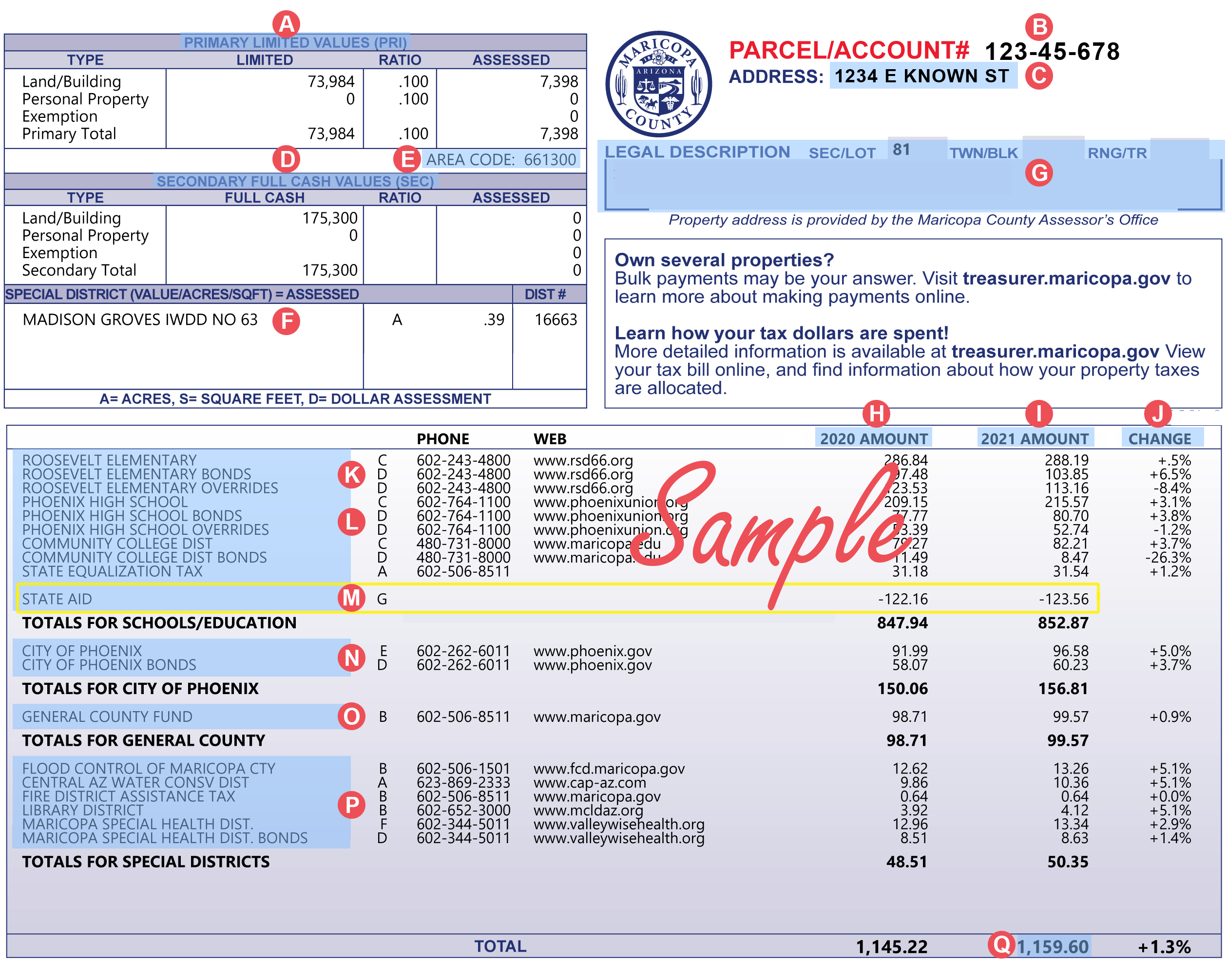

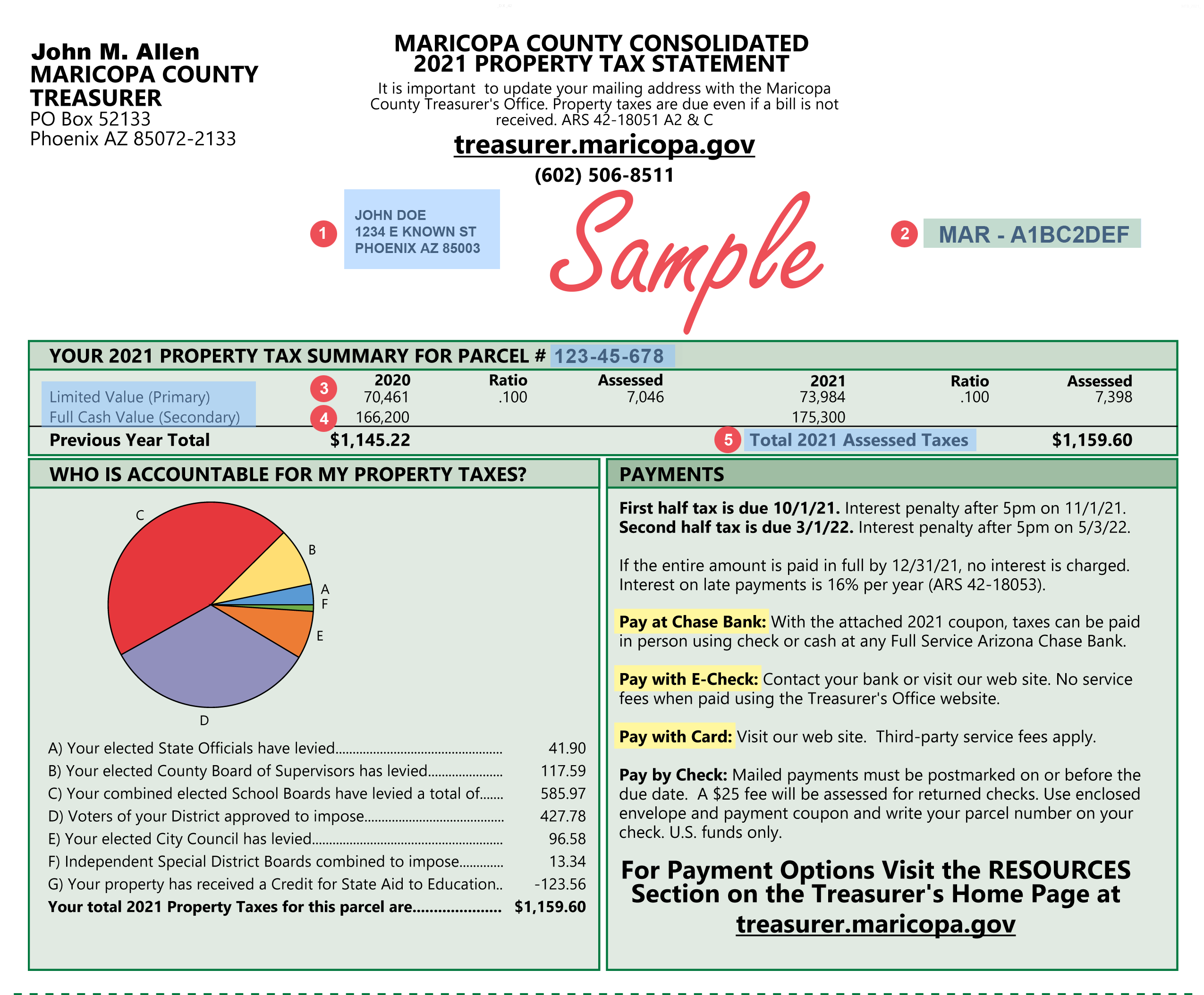

All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St 140 Phoenix Arizona 85003 attention Tax Lien Department or. The Maricopa County Assessors Office offers electronic notices or eNotices for Notices of Valuation. The Court adjudicates cases involving state taxes municipal sales taxes and property taxes as well as appeals from the Property Oversight Commission.

Unsold Maricopa County Arizona tax lien certificates sold to the state of Arizona at the Maricopa County tax sale are available for purchase by investors through assignment. It is a lien for the amount of delinquent taxes plus interest and other fees. Maricopa County AZ currently has 13 tax liens available as of March 9.

A number will be assigned to each bidder for use when purchasing tax liens through the treasurers office and the online tax lien sale. It usually gives a creditor the right to take ownership of any equity that exists in the property to secure the payment of the debt. Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be provided within 24 hours to the taxpayer.

Many other states and even counties in Arizona run the tax lien. First you need to consider what a tax lien is and how it can benefit you. A list of properties with prior years delinquent taxes will be published in the newspaper of general circulation for Pinal County.

Feb 2 2022. The site will close in January in preparation for the tax sale. How does a tax lien sale work.

Contact or behavior of a certificate holder deemed unfair. It truly is a business of abundance. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax.

As of september 14 maricopa county az shows 17298 tax liens. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Contact with property owners initiated by certificate owners to encourage payment at any time is not recommended.

Lease keep in mind that the following information is specific to Maricopa County. This makes tax lien investing very safe. Enter the Assessor Parcel Number APN to search for and then click on Go.

The interest rate paid to the county on delinquent taxes is 16. When a lien is auctioned it is possible for the bidder to. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the State of Arizona.

Maricopa County Arizona tax lien certificates which have been held by the state of Arizona for less than 3 three years are available for purchase by assignment. Riverside County Tax Collector California. 9 Arizona counties have now released their 2022 Tax Lien auction properties.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. As of september 14 maricopa county az shows 17298 tax liens. Auction properties are updated daily on Parcel Fair to remove redeemed properties.

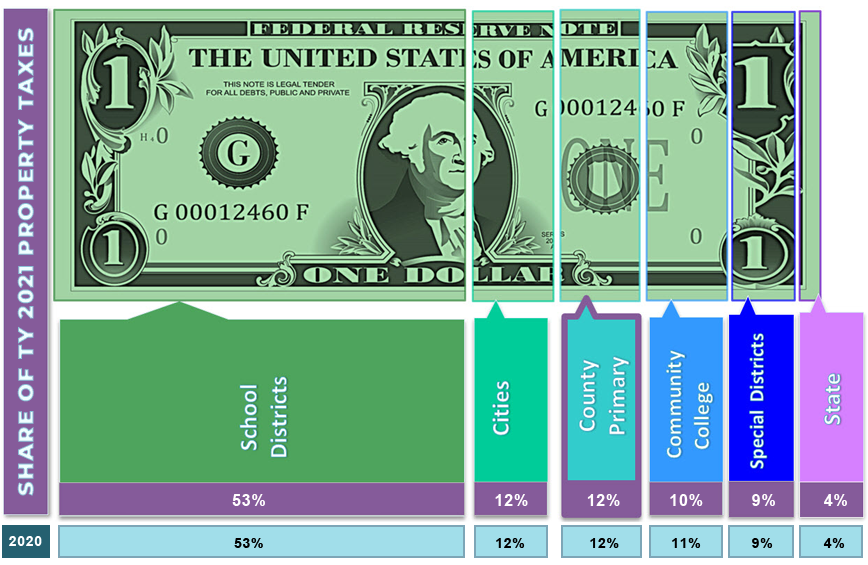

Every year the counties have auctions to sell these unpaid property tax liens. Select the township range and section to search for and. Please allow 2-3 weeks for the full release to post with the appropriate County Recorders Office andor Secretary of State.

These parcels have been deeded to the State of Arizona as a result of a property owners failure to pay property taxes on the parcel for a number of years. The Online Tax Lien Sale will be open to the public each year in February for purchase of tax lien certificates. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Missouri Gas Tax Bill 2021. Best Dining In Melbourne Fl. Arizona has 15 counties and in Maricopa County alone they could have 15000 or more tax lien certificates available.

Maricopa County Tax Lien Map. If there is a tie either the first to bid that amount wins or the county uses a random number generator to pick a winner. Enter the address or street intersection to search for and then click on Go.

ONLINE TAX LIEN SALE. Investors are allowed to bid on each Arizona tax lien. Arizona allows investors to purchase unpaid real property taxes from counties as an investment in the form of tax lien certificates on real property.

New Smyrna Restaurants On Us1. Enter the property owner to search for and then click on Go. The bidding starts at 16 and goes down from there potentially all the way to 0.

Jefferson Suite 100 Phoenix AZ 85003-2199 602 506-8511 httpwwwtreasurermaricopagovPagesLoadPagepageLiensAndResearch. Interested in a tax lien in maricopa county az. In Maricopa County Arizona a lien is a security interest placed on a piece of property typically land or a house to secure the payment of a debt.

Signing up for an eNotice is easy to use convenient provides archives and saves the County and its taxpayers money by reducing printing and posta. Arizona maricopa county tax lien. Maricopa County AZ currently has 17198 tax liens available as of April 6.

Arizona Tax Auction Update.

Here S What It S Like To Get Covid 19 In The Maricopa County Jail Phoenix New Times

Maricopa County Island What Is It Arizona Homes Horse Property

Amazon Com Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen

Pin On Famous Arizona Architect Homes For Sale

City Limits Maricopa County Az

Amazon Com Maricopa County Arizona Zip Codes 48 X 36 Matte Plastic Wall Map Office Products

Aclu Maricopa County Attorney S Office Prosecutions Are Racially Biased Phoenix New Times

Jake Hoffman Arizona Republican Bill To Carve Up Maricopa County Into Four New Counties Stalls In House Phoenix New Times

Maricopa County Zip Code Map Area Rate Map Zip Code Map Metro Map Map

Maricopa County Assessor Interactive Map Government Affairs

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Pay Your Bills Maricopa County Az

Displaced In America Housing Loss In Maricopa County Arizona

Maricopa County Arizona Federal Loan Information Fhlc

Jake Hoffman Arizona Republican Bill To Carve Up Maricopa County Into Four New Counties Stalls In House Phoenix New Times